A New Generation of Indicators

The Auction and the Limit Order Book

Generally speaking a market is a place where buyers meet sellers to perform trades, and where prices adapt to supply and demand. Today, most markets implement an electronic continuous-time double-auction mechanism based on the essential idea of a Limit Order Book (LOB). Every transaction of every trade at an exchange is recorded in a Limit Order Book (LOB). It is a standardized book keeping mechanism which is used to keep record of every two-sided-auction. Bookmap and TTW-MarketVolumePro

Bookmap Limit Order Book

With an accurate data feed the LOB presents in time non-lagging trading information or in other words the buying and selling desires of traders. The auctioneer collects and records this information. When posting bids or offers, each trader enters into a firm commitment to trade if he or she wins the auction. The commitment is called liquidity provision.

The auctioneer gathers these bids and offers into an order book. The order book describes the quantities that are available for purchase or sale at each specific price.

Today market makers (market agents, specialists) provide liquidity because they are legally obliged to maintain a fair and orderly market, in exchange for some special privileges. Market makers has two tasks: quoting and clearing.

Why is this important?

Because LOB facilitates trades and is updated in real time observable by all traders! No designated market-makers or auctioneers are required. The e.g. CME matching algorithm matches according price, time priority. Analyzing transactions and price changes in the LOB provides a direct route to quantifying and understanding price dynamics. It is the heart of modern trading and market microstructure. Bookmap and TTW-MarketVolumePro

Understanding the LOB and its mechanism puts yourself in control!

The Problem

Understanding the LOB and its utilization in trading is for most traders not common and therefore not well accepted. Education is rare and hard to find.

As mentioned above, trader must look at two sides of the market:

- Limit market order

- Aggressor or market orders

Understanding the limit part of order book will teach you how

- market makers are adding, cancelling orders

- institutions use imbalances to manipulate the mass of traders

- they lure traders in

- “big boys” distribute and accumulate and much more

- and much more

Understanding the aggressor part of order book will show you

- When aggressors come into the market

- How they behave

- How much do they trade

- How aggressive they are

- When they disappear

The trading aspect which is hard to predict is: “How do aggressors behave and WHEN they come into the market to significantly drive the market in one direction.”

What we know is that market makers are using limit sides of an LOB as a “honey pot”. As I am always stating: “Time” is, besides “Price and Volume”, the most important part of trading.

Trading Trinity = Price, Volume, Time

Bookmap and TTW-MarketVolumePro

Bookmap is the only trading program currently on the market which can depict above described LOB situation as a “2D” presentation on the screen in an understandable and comprehensible way.

Let me show you:

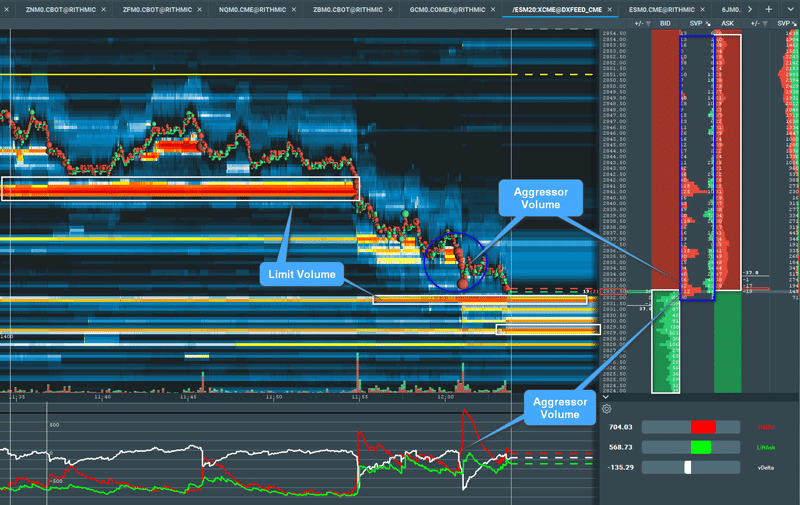

Presentation of the Limit and Aggressors in Bookmap

With this information we have a complete picture of a liquid market. Doesn’t matter whether we trade indices or shares. As long as we trade non-artificial markets like micro-forex and other derivatives, where the “broker” directly is your opponent, your data and volume provider, see here, we can rely on objective market information.

This objectivity gives us an edge over other retail traders who are not utilizing this valuable information for trading.

Data Feed

It is important to stress the data feed situation. Don’t underestimate the quality of data!

One question:

“How can a trader make objective decisions based on wrong information or data?”

You are for sure familiar with the expression “Garbage in, Garbage out” or “Rubbish in, Rubbish out”. That simply means if you feed your system with incorrect data you will come to incorrect or nonsense decisions.

The presence of detailed data feeds like Market-by-Order and its presentation in Bookmap lead to a complete new view on traded markets. It is an evolutionary approach and thus a paradigm change in trading! Bookmap and TTW-MarketVolumePro

With accurate MBO data can see in detail, even in micro view, what the market, we are interested in, is doing. We start to understand his language, his behavior and his intents. Comparison of market data sources.

New Generation of Indicators for Professionals

TTW-MarketVolumePro

The challenge in trading is to connect “Limit Orders” with “Market Orders” and to derive the next steps in trading based on this information.

TTW-MarketVolumePro ties together both sides – Limit and Market orders. It analyses aggressor traded volume and indicates the skilled trader what the market is actually doing and what the next step could be.

The Idea Behind

Based on described facts above, knowing how to read the LOB based on MBO data for trading, gives us a chance to develop a new generation of indicators which allows the “order-by-order view” for liquid markets.

The idea behind is to find answers to following questions:

- When do price stop or is about to stop?

- Who is in charge of a price move?

- When do buyers / sellers dominate?

- How to identify algorithmic trading?

- When do markets decelerate / accelerate?

When does Price Stop or is About to Stop?

What are Bid – Ask Imbalances?

Order imbalances exist when there is an excess of buy or sell orders for a specific future or security. Order imbalances often occurs when major news comes in and optimistic aggressors trades one side of the LOB more excessively than the other side. Imbalances can move future to the upside or downside, but most imbalances get worked out within a few minutes in the daily session. Bookmap and TTW-MarketVolumePro

Bid-Ask imbalances mirror the law of supply and demand:

- The law of demand says that at higher prices, buyers will demand less of an economic good.

- The law of supply says that at higher prices, sellers will supply more of an economic good.

- These two laws interact to determine the actual market prices and volume of goods that are traded on a market.

- In case of imbalances price must come to an equilibrium.

Examples:

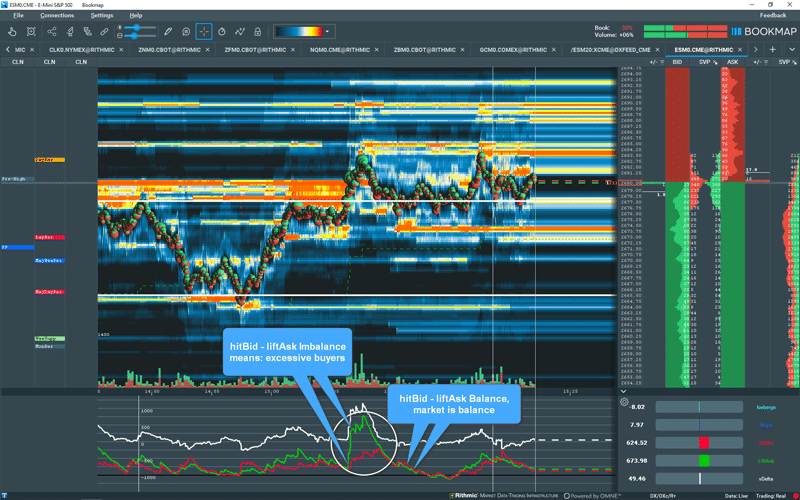

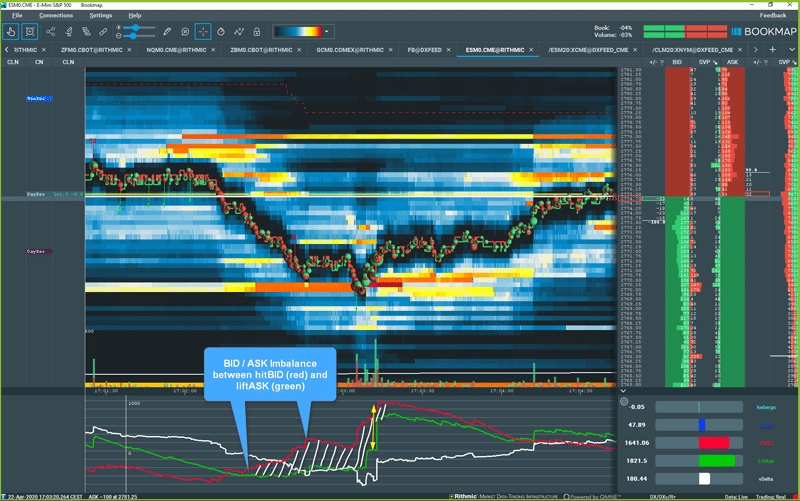

TTW-MarketVolumePro indicates obvious where the excesses happen.

TTW MarketVolumePro:: Bid Ask Imbalances

TTW MarketVolumePro:: Bid Ask Imbalances

Trading Advise:

- Trail your stop – use ATR, Chandelier Stop, etc. for example.

- Take partial profits

- Watch context of market

- Is the market exhausted?

- Is it only a break?

- Details about the context here.

- Close your position

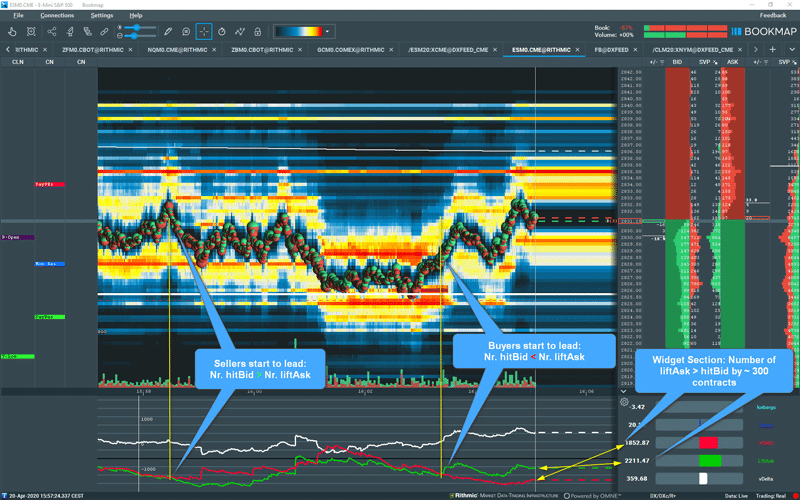

Who is in charge of the Price Move?

Buyers or Sellers?

TTW-MarketVolumePro measures aggressors behavior and thus indicates who is controlling the market at that specific moment. Just to make clear: Aggressors are traders who remove liquidity from the markets by entering buy and sell orders at current at-market prices.

Knowing that, we can see when aggressors are buying from sellers, or in other words are hitting the Offer. Otherwise, we can see when aggressors are selling into bids or hitting the bids to bring the price down.

TTW-MarketVolumePro has 2 options to pinpoint the price movement:

- On the X-Axis with hitBid or liftAsk curves

- Numerical expressions in Bookmap widget section

TTW-MarketVolumePro:: Price Leading Options

It is important to note that TTW-MarketVolumePro must be used with other order flow activity. TTW-MarketVolumePro is a great help because it outputs objective data about the types or orders and specific players in the market. This important information offers a significant level of transparency that can be used to gain a powerful edge together with many various strategies and trading methodologies.

When do Buyers or Sellers dominate?

Where do they start to dominate?

TTW-MarketVolumePro has a unique indicator which calculates 2 trading events based on the incoming Market-by-Order data

- vDeltas or Divergences

- Stop Runs

Volume Delta (vDelta) or Divergence

Divergence in technical analysis may signal a major positive or negative price move. A positive divergence occurs when the price of an asset makes a new low while an indicator, such as money flow, starts to climb. Conversely, a negative divergence is when the price makes a new high but the indicator being analyzed makes a lower high.

Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction.

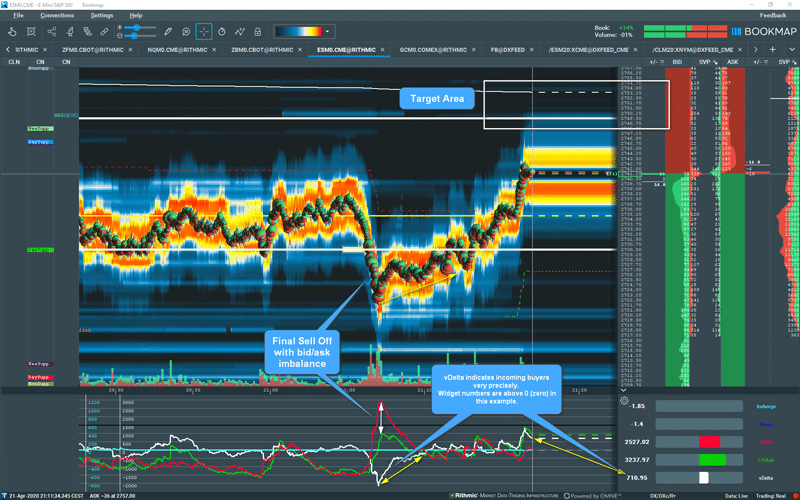

vDelta measures the traded Bid minus Ask volume and pinpoints exactly during the traded event which side, buyers or sellers, starts to lead the market and lead to the price changing direction!

vDelta answers following question very precisely:

- Which aggressors, buyers or sellers, starts to trade actively on which side?

Main point I want to emphasize is “to start“. As a result of lagging, aggregated market data nearly all common indicators results are signals which are too late. Too late to react or to execute trades. Bookmap and TTW-MarketVolumePro

Not so vDelta! While we rely on Market-by-Order data it is possible to recognize when the market turns into one direction. Reason is that at a certain time point one side of aggressors kicks in. Subtle and hardly visible but still on intention to lift the Offer or hit the Bid.

vDelta measures the traded volume of both sides, Bid and Ask, and starts to indicate changes long before common indicators react.

Examples:

TTW-MarketVolumePro:: vDelta

Trading Advise:

- Use vDelta as leading indication for divergences

- Watch for differences between Bid and Ask

- You must understand the context for your traded market to utilize vDelta as it is intended

- Liquid and illiquid markets make a difference in the usage of vDelta

- You must understand the meaning of liquidity and aggregated and non-aggregated data to utilize vDelta as designed.

It is important to note that TTW-MarketVolumePro must be used with other order flow activity. TTW-MarketVolumePro is a great help because it outputs objective data about the types or orders and specific players in the market. This important information offers a significant level of transparency that can be used to gain a powerful edge together with many various strategies and trading methodologies.

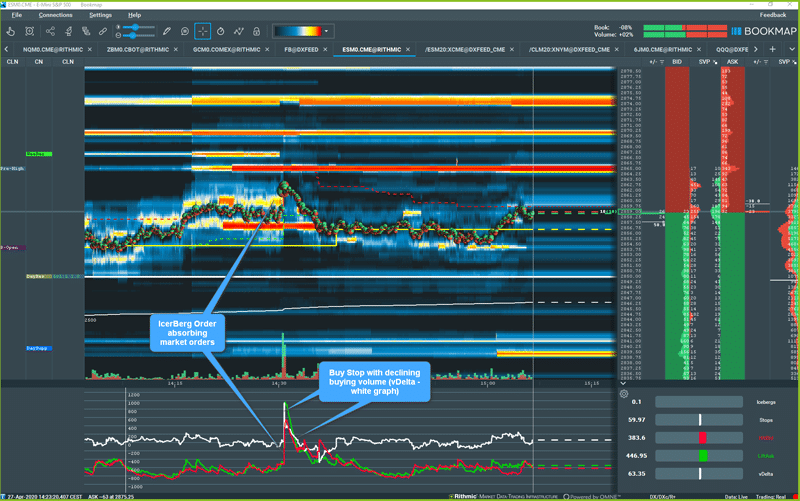

Stop Runs or Volume Spikes

A practice among professional traders of pushing the price of a stock up (or down) through a resistance (or support) level where they believe investors have placed stop orders. When the stop orders are hit, they trigger market orders and/or limit orders, which cause a spike (or drop) in the price at which point the professionals reverse their positions and ride the stock in the opposite direction.That means when Stop Orders are triggered they become aggressive market orders and transact at the current market price.vDelta or Stop Run indicator indicates the Stop Runs for 2 directions:

- Buy Stop Order transaction is a positive value or positive peak.

- Sell Stop Order transaction is a negative value or negative peak.

Examples:

TTW-MarketVolumePro:: Buy Stop Orders and IceBerg order

TTW-MarketVolumePro:: Stop Orders with IceBerg orders

TTW-MarketVolumePro: Buy Stop Order with Liquidity Absorption

TTW-MarketVolumePro:: Stop Orders hitting IceBerg Orders

Stop Run Characteristics:

- Stop Run or Sweep is an extreme fast move up or down

- Mostly a 90° move which means a very short-term move (few seconds)

- Ignited by algos based on exogenous events

- Algos are triggering, hitting certain price levels

- Directional price change possible

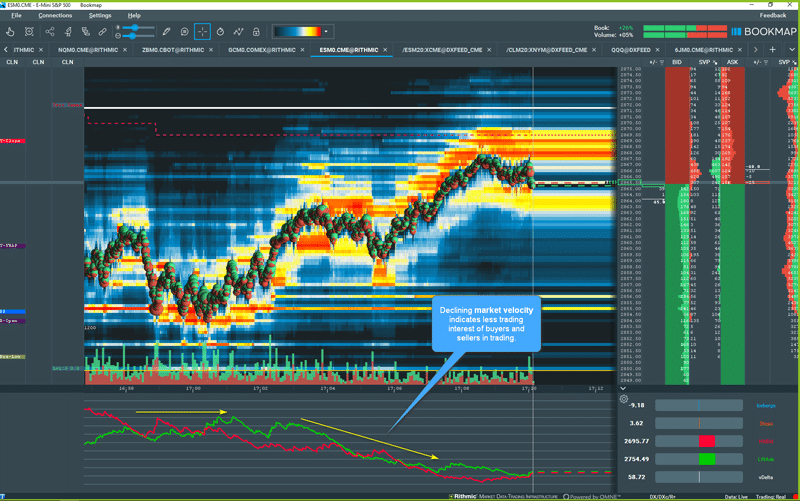

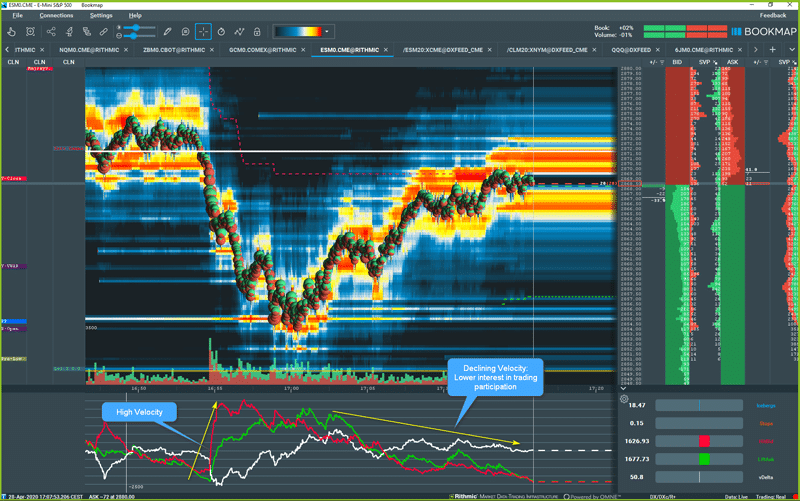

Market Velocity

In general, Market Velocity measures the intensity of trading interest using MBO data entering a trading system. Market Velocity measure levels of order activity to indicate the intensity of trading interest and relative buy versus sell pressure.

TTW-MarketVolumePro indicates market velocity by the “steepness” of the hitBid and liftAsk indicator.

Following can be derived based on the indication of market velocity:

- Declining market velocity indicates less trading interest

- Sideways market velocity indicates a pause in market interest

- Rising market velocity indicates interest in trading

- In a selling or buying market

- Steep velocity indicates an unusual strong market participation

- Begin and end of a session

- Volume Spikes

- Stop Runs / Sweeps

Examples:

TTW-MarketVolumePro Market Velocity

TTW-MarketVolumePro Market Velocity

Conclusion

I am making my trading decisions solely based on what market tells me during the trading day.

Let the market speak and show you his hand!

Based on that what market offers me daily I am acting upon or not. Interpreting markets language is an important part of my life and online seminar.

Saying that, I am watching the LOB, its graphical presentation of the LOB in Bookmap, obeying external influencers like Option Market Makers and their levels. Overall market conditions are given by VIX, Nyse Issues and further important market correlations.

TTW-MarketVolumePro measures based on Market-by-Order data every single transaction between market and limit order. Bookmap and TTW-MarketVolumePro

That’s new because now we are in the position to see where buyers come in and where seller start to trade the market down.

You are the decision maker and not the chart or the indicator.

This makes a big difference between an independent and dependent and an informed and uninformed trader.

Visit my YouTube channel for more educational material

https://youtu.be/8w8jw9WyDvohttps://youtu.be/aBjGNPUMjBUhttps://youtu.be/ghgPPw0J5sc