What’s amazing and new?

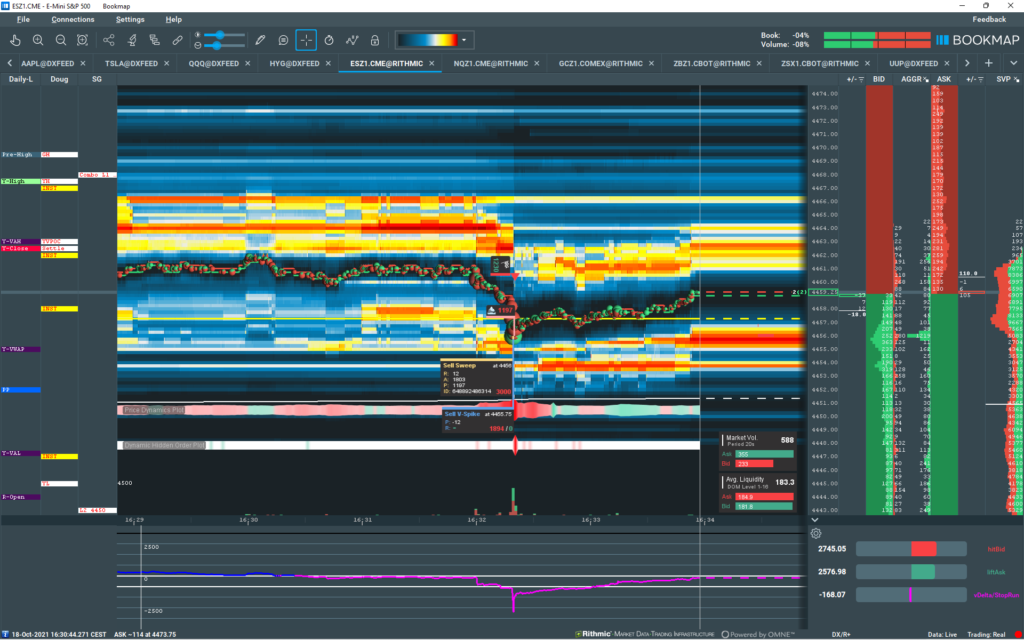

Price Dynamics Plot

TTW-LiquidityTracker is besides HiddenOrders and MarketExplorer the heart of TTW-TradeFinder. TTW-TradeFinder Version 3

Hidden Liquidity changes and their indications in real time on chart are of invaluable information for every trader. In case you are utilizing the DOM for your trading, you will see sudden hidden liquidity changes, which indicates whether the market will support or resist the price at a price level.

That happens — dependent on your settings and instrument — BEFORE the price trades at those price levels. We have added a visual presentation of how passive and aggressive orders influences the order book.

TTW-TradeFinder Price Dynamics Band.

Price Dynamics depicts price exhaustion and colorizes buyers or sellers sentiment.

As you know, an order is a commitment to buy or sell a given volume of an asset at no worse than a given price. We wanted to know and see how aggressors dictate the direction of the price.

The idea of a non-lagging, real-time indicator was born. Price Dynamics considers the strength of aggressive AND passive limit orders in the book.

We can say, that this is a snapshot of the relative strength or weakness of the market at any time.

You know what’s spectacular?

You will see the price snapshot for every available instrument in Bookmap. It doesn’t matter whether it is a:

- Rithmic instrument

- dxFeed instrument

- CEDRO, or other data feeds

It works data feed independent. However, we haven’t tested the accuracy with other data feeds than Rithmic or dxFeed.

Every trader using this unique presentation of price movement in the order book will experience an edge in his or her trading.

Dynamic Iceberg Development

Besides Iceberg detection routines and their handling on the chart, we have added, as we call it, Dynamic Iceberg Development.

Please see my video on “How to spot icebergs with TTW-TradeFinder” On YouTube.

Just for the reminder:

to detect native Icebergs, you will need a MbO Data feed, as provided by Rithmic.

Synthetic icebergs, however, will be detected with non-MbO data feed, like dxFeed.

TTW-TradeFinder will analyze and display all synthetic icebergs for every instrument independently of data feed for futures, stocks, ETFs.

That’s one of the new and improved function which comes with TTW-TradeFinder Version 3 around hidden orders.

TTW-TradeFinder DID

TTW-TradeFinder Dynamic Iceberg Development

A native iceberg is “hidden” behind a single Order ID Once the price hits that specific order-ID the volume of that order-ID is being refreshed until the expected volume is finally transacted.

We found that order-ids can last for long time in the book and await execution at distant prices.

But when the order is traded at the awaited price level, the order need more than one fill to complete.

We call that specific native hidden order progress:

Dynamic Iceberg development.

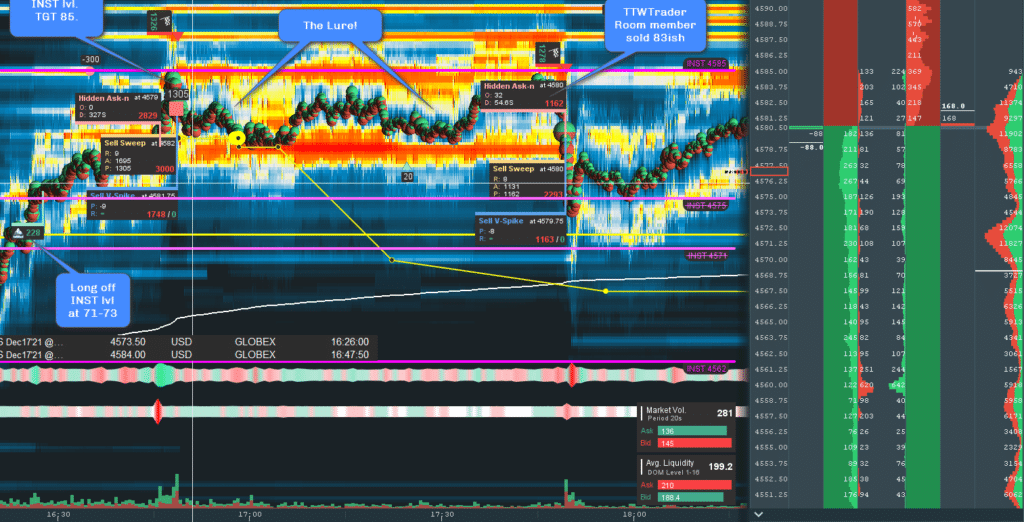

Enhanced detection of sweeps

The Trading-To-Win team has good practical reasons to distinguish between

- Sweeps

- Volume Spikes

- Absorption

Sweeps are single Order-ID events driven by Algos. Their purpose is to sell or buy numerous contracts in a row.

According to our investigation, a sweep is executed

- Surprisingly, in milliseconds

- Empties the book at the end of the sweep

- Executes at a certain price

- Sweeps through several ticks and points

- Want to sell or buy a certain number of contracts.

TTW-TradeFinder Sweep Calculation.

As you can see here, the ALGO wanted to sell 3000 contracts. That’s designated by the number 3000.

At that time, the order book was filled with resting limit orders on BID of about 1800 contracts.

And important as well is that the order book was swept between 4459 and 4456, that are exactly 12 ticks in the ES future which means 3 ES points.

Since his order was not filled completely with 3000 contracts, he bought 1197 contracts to be flat and closed his trade.

A second later he places an iceberg order on ASK and buys back the remaining 1197 lots.

Finally, he sold 1803 contracts.

TradeFinder labels all sweeps with vital information like

- R = Price level

- A = Active and means he sold 1803 contracts actively

- P = Passive and that means that 1197 remained open which has been bought back one second later.

His order is closed, and he is probably luring for another opportunity where his Algo need to detect — let’s say another 3000 contracts in the book which could be traded in milliseconds.

We will never know what is or are the reasons for sweeps of that size. It could be selling or buying of a big institution, or hedging against higher prices to keep the delta neutral.

We can build strategies upon these phenomenons because they all have one in common:

An empty book after the sweep.

Strategies based on TradeFinder and Bookmap are the main part of the upcoming 4-day hands-on seminar with live trading.

Volume Spike or Stop Run?

One word to Volume Spike Signal, which we have renamed from Stop Run into Volume Spike.

Since TTW-TradeFinder works with every instrument, we don’t see Sweeps in instruments for which we don’t have MbO data.

However, we can spot volume spikes for every instrument. A volume spike is based on volume and TIME which is needed to transact.

As well, we are more reluctant to speculate about stop runs behind every single fast move.

A part of these spikes are for sure stop runs.

According to our investigation, based on Stocks and Futures, there is no general evidence which allows a conclusion that behind every small volume spike we can say that’s a stop run.

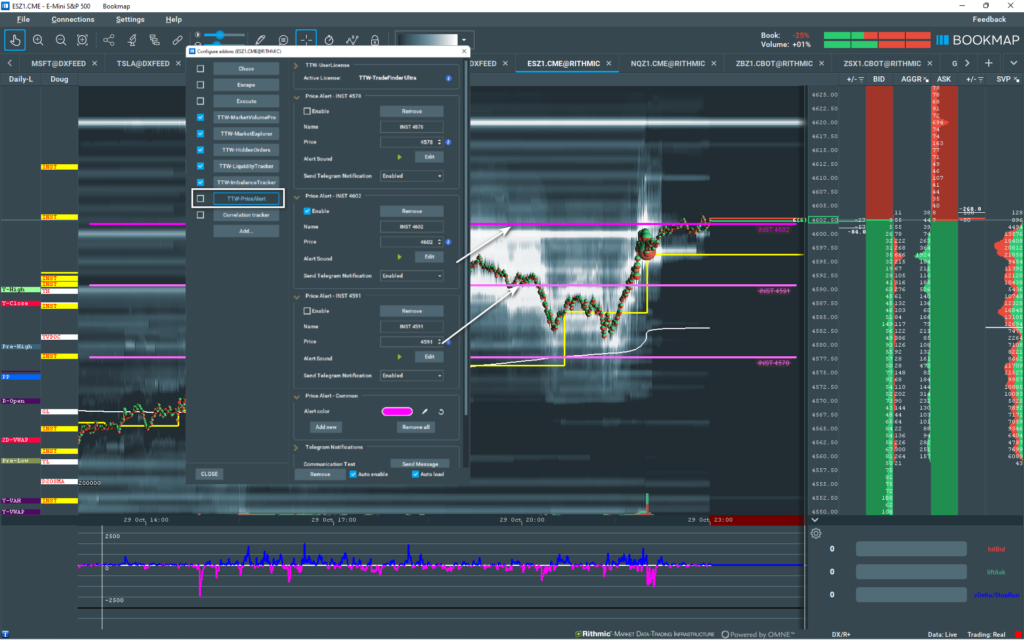

PriceAlerts and their settings

The intention of PriceAlerts is to give you better horizontal line drawing possibilities for any instrument you are trading and analyzing in Bookmap.

We have received many request concerning tools which can generate and send alerts either as sound on your workstation or on Telegram when an important price level was reached and hit.

TTW-TradeFinder Price Alerts Module

That’s the main goal of TTW-PriceAlerts, which are now a module of TTW-TradeFinder for Bookmap version 3.

In parallel, you can be notified on your messenger, which in this case is Telegram.

Once the line is triggered, the price line is still there, but the info field is crossed because the price already touched your defined price level.

TTW-TradeFinder and TTW-MarketVolumePro are real-time non-lagging indicators which will enhance your trading probability beyond 50 %. TTW-TradeFinder Version 3