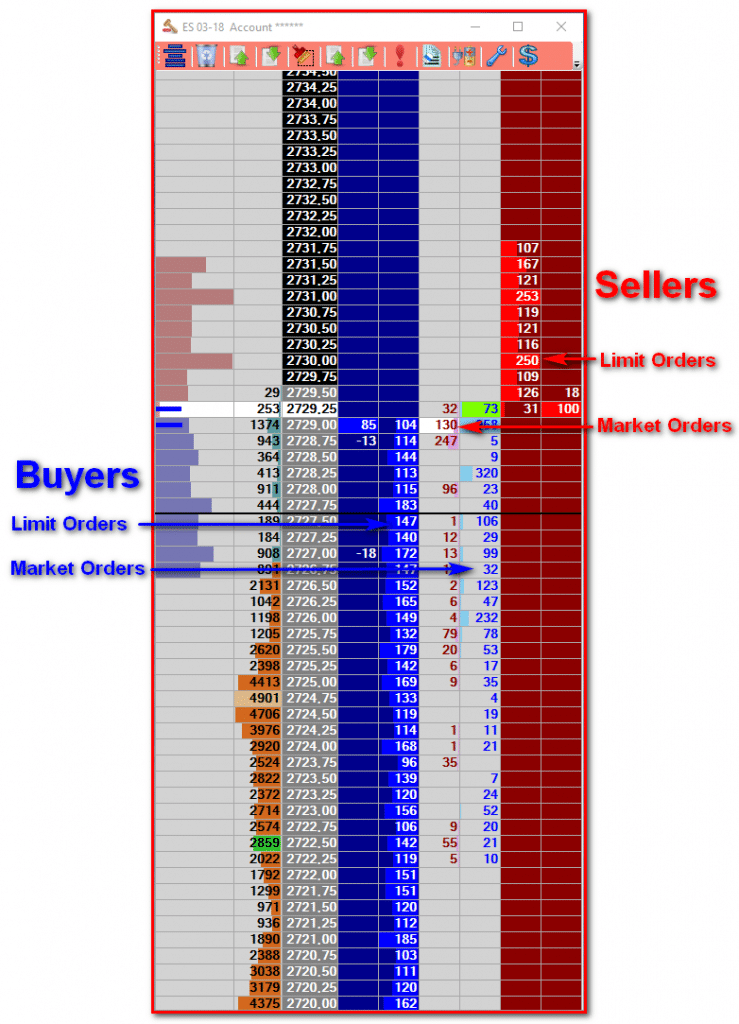

In modern electronic markets, liquidity is self-organized, in the sense that any agent, market maker, participant can choose, at any instant of time, to either provide liquidity or consume liquidity.

Market participants provides liquidity by placing Limit Orders or they consume liquidity by Market Orders.

The liquidity model applies to all timeframes. It is easier to explain liquidity on the lowest level possible which is the order book. The limit order book is the place where all buyers and sellers meet and where the auction takes place. It is basically the entire supply and demand.

If you understand the liquidity model, you will understand that the market is rising because of a lack of sell side liquidity and NOT because buyers are jumping into the market.

Let’s start with an common example.

Don’t Trade the news

Every trader should know this simple truth: “Don’t trade the news!“ because news releases cause some pretty violent movements in price.

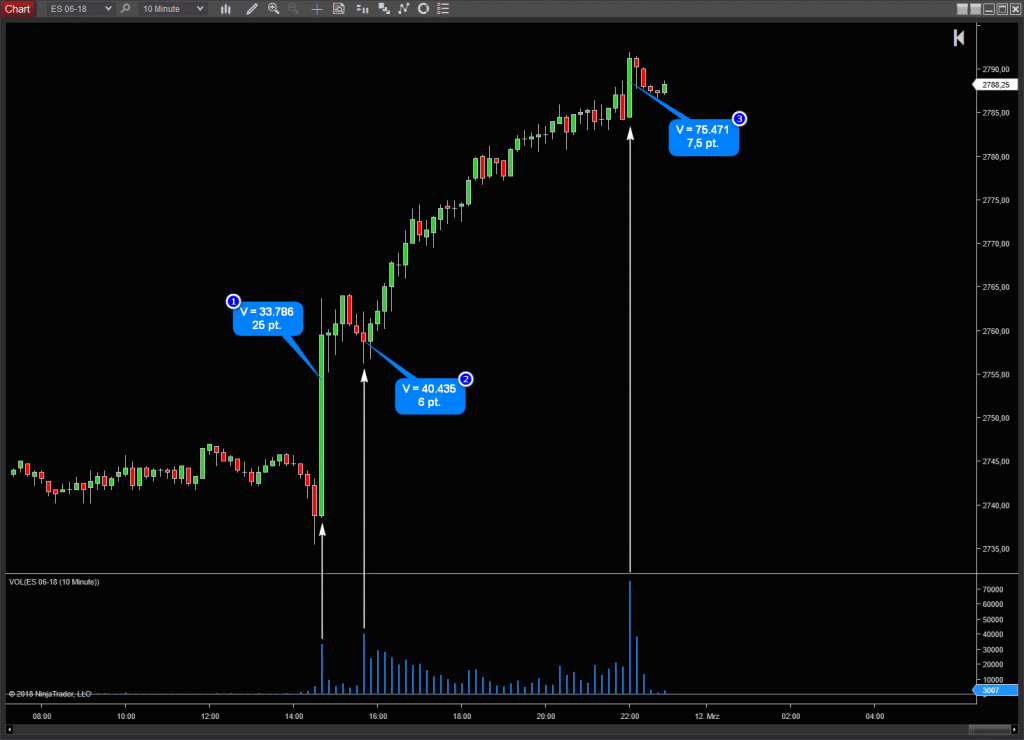

When, in this case NFP data, were released on Friday, market traded (1) 33.786 contracts within a time frame of 10 min. Price jumped up for 25 points!

There were 2 other events with much bigger volume traded.

(2) At 9:30am 40.435 contracts traded and market moved for only 6 points and at 4:00pm (3) there were 75.471 contracts traded and the price moved 7,5 points.

The reason for the first big move is caused by lack of liquidity. This makes such moves so large.

Conclusion: Traded volume is only a part of the whole picture. It is liquidity or lack of liquidity that causes such big moves.

What is liquidity?

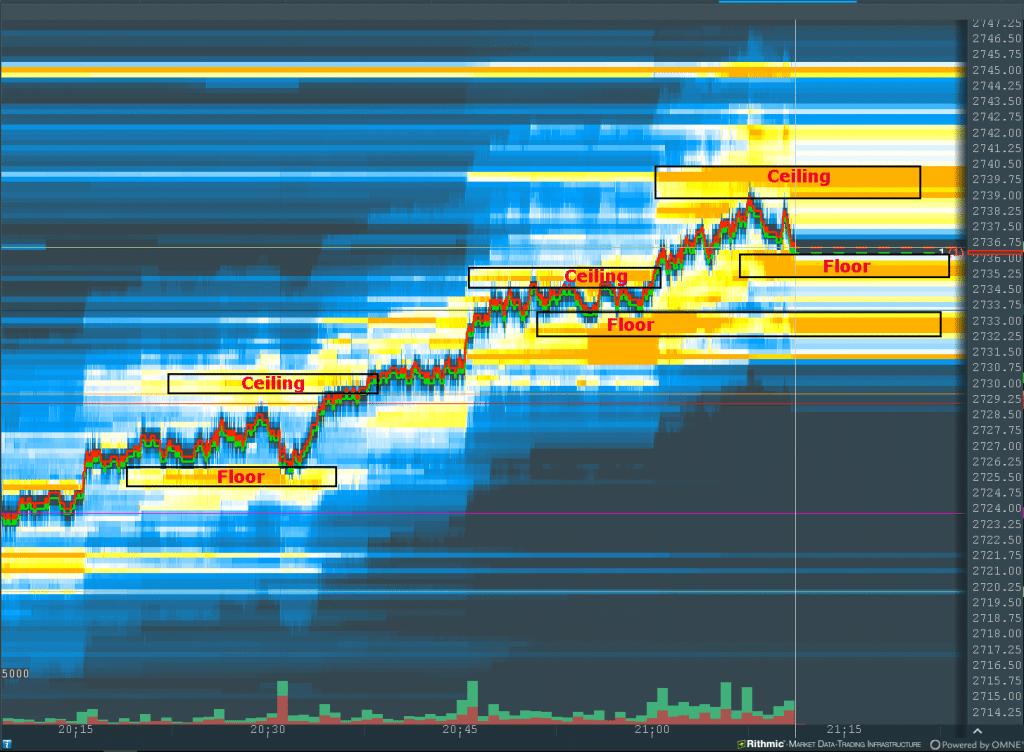

Imagine for a minute that the market is a hi-rise building. Price can rise up when the ceiling is broken and it can move down when the floor is broken. The market does have a ceiling above and a floor below. This is in the form of limit orders and this is what we refer to when we talk of “liquidity”. In the market some floors/ceilings are thicker than others and some are thinner than others.

Something needs to “eat” these ceilings for price to move up. The eater of liquidity is called a “market order”. When someone submits a market order to the market it eats some liquidity and makes that floor/ceiling a little bit thinner. To trade a market you either need to provide liquidity (limit order) or consume liquidity (market order).

This is what causes price moves. You will often hear people say “price moves up when there are more buyers than sellers”. This is impossible. The markets are a mechanism for matching buyers and sellers. If there is no seller, you will not be buying anything. The markets move up because buy market orders consumed seller liquidity at a price level. The next buy market orders will eat the liquidity at a higher price.

The numbers of contract bought = the number of contracts sold.

Visual presentation of a Limit Order Book:

Ceiling / Floor Example

Presentation of market data in a Limit Order Book:

Limit Order Book Market Data presentation

Continued on Liquidity, Part 2