See also: https://ttwtrader.com/docs/sweeps/

Sweeps #

Definition #

The sweep signal utilizes Market-By-Order Data (MBO) to identify and track all unique market orders through their individual order IDs to quickly identify when a large, aggressive order transacts in the market. The signal will print immediately and then remain historically on the chart at the price level of the sweep. You can also adjust the settings to receive alerts for the signal.

Strategy #

After a large sweep occurs, the market either turns in the opposite direction, acting as price exhaustion, or it moves in the same direction, signaling an informed participant has entered the market. Therefore, it is important to watch how the market reacts afterward.

License #

ULTRA

Scheme #

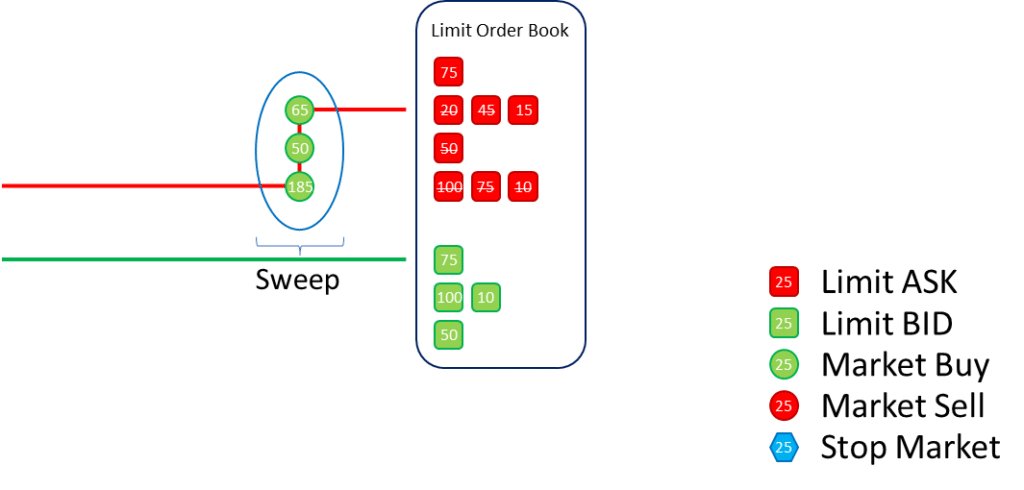

A sweep is a single large market order.

In this example, someone bought 300 lots, which increased the price by two ticks.

Sweep Signal #

Based on the values in the sweep settings, which should be adjusted to fit the traded market, the sweep signal is the output anytime a large market order is traded with a single order ID.

Important: MbO data is required to analyze and display sweeps!

Example #

There are 3 sweeps. 2 sell sweeps and 1 buy sweep.

Settings #

Settings window for Sweep Signal

Sweep Signal

Enable the checkbox to enable Sweep Signals on the trading chart.

Trigger Volume

A single order ID must trigger the market volume to qualify as a Sweep Signal.

Value Range: 1–100000000 Increment: 1

Price Range [ticks/cents]

The price range in ticks/cents defines the minimum price range that must be swept through to trigger the alert. Value Range: 1-1000 Increment: 1

Design and Layout

Click on the “Edit”-Button to change the design, symbol, color, transparency, layout, position on the chart, and size of the signals on the chart. If you choose the design style “professional,” you will get additional information about the sweep signal.

Alert Sound (Live Trading only, not available in Replay)

The audio signal sounds when a sweep occurs and meets the defined conditions.

Send Telegram Notifications (Live Trading only, not available in Replay)

Enabled / Disabled allows you to notify the messenger service “Telegram”.

Enable Bookmap Notifications (Live Trading only, not available in Replay)

Enabled / Disabled activates the Sound Alerts in Bookmap.

Sweep Signals:

We have a selection of colors to select from. The default is green for a Buy Sweep and red for a Sell Sweep.

The signals show the characteristics of a Sweep:

- P: Price Level where the Sweep occurs

- R: Range or price change of the Sweep in ticks or pips

- A: Actively traded volume (market order)

- P: Passive traded volume (limit order)

Note: As a rule of thumb, a sweep is executed with market orders. However, intelligent algorithms can give a part to the passive side to get a better average price!

Blue Colored Sweep #

A blue colored Sweep represents a

- Single Stop Run! as a Sweep

Several blue-colored sweeps can be single events or will appear on the chart with a Native Stop Run.

Example #

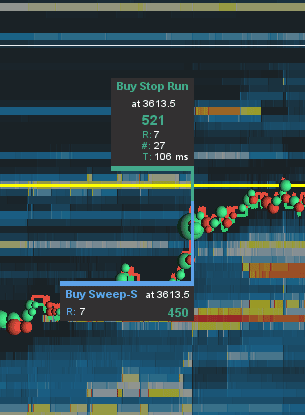

The example above shows a real-time Native Stop Event on the chart.

The Buy Stop Run includes the following real-time information

- Buy Stop Run or Sell Stop Run

- Executed at a price of 3613.50 ES.

- 521 lots were executed market

- Stop run took 7 Ticks

- 27 orders were traded to execute 521 lots at market

- The transaction took 106 ms to finish the stop run

Blue Sweep #

1 single stop order was executed with a size of 450 contracts.

Please read as well Native Market Volume Stops