Volume Spikes #

Definition #

Volume Spikes are clusters of large orders that are executed in a certain amount of time through a definable set of ticks.

Strategy #

When Volume Spikes happen in liquidity, it can signify a counter-movement of the market.

License #

PRO, ULTRA

Volume Spike Signal #

Volume Spikes indicate significant, rapid market movements where high volume is traded in a very short time. TTW-TradeFinder draws Volume Spikes in real time based on predefined signal filters, which can be adjusted individually to fit any liquid, tradable instrument. The Volume Spike Signal must be set individually for each traded instrument based on its respective average liquidity and average volume measurements. To assist with fine-tuning the settings, TTW-LiquidityTracker is equipped with a unique Current Average Liquidity meter and Current Average Volume meter. Based on these objective liquidity and volume measurements, you can determine the best settings for any stocks, futures, or cryptos.

Scheme #

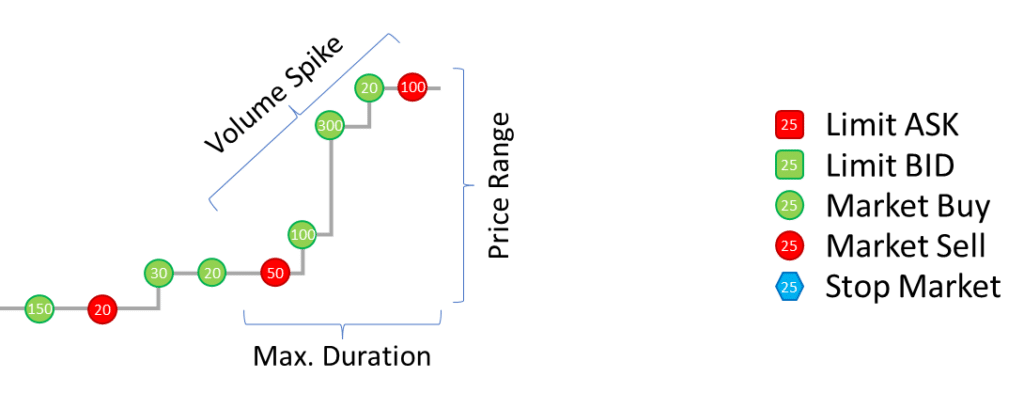

In this example, 420 buys and 150 sells were accumulated during the specified duration.

The ratio between buy and sell volume was 420/150=2.8, and the price increased by x ticks, indicating a „buy volume spike“.

In case of a „sell volume spike“, the ratio is calculated the other way around as „sell volume/buy volume“.

Example #

Volume Spike Principle #

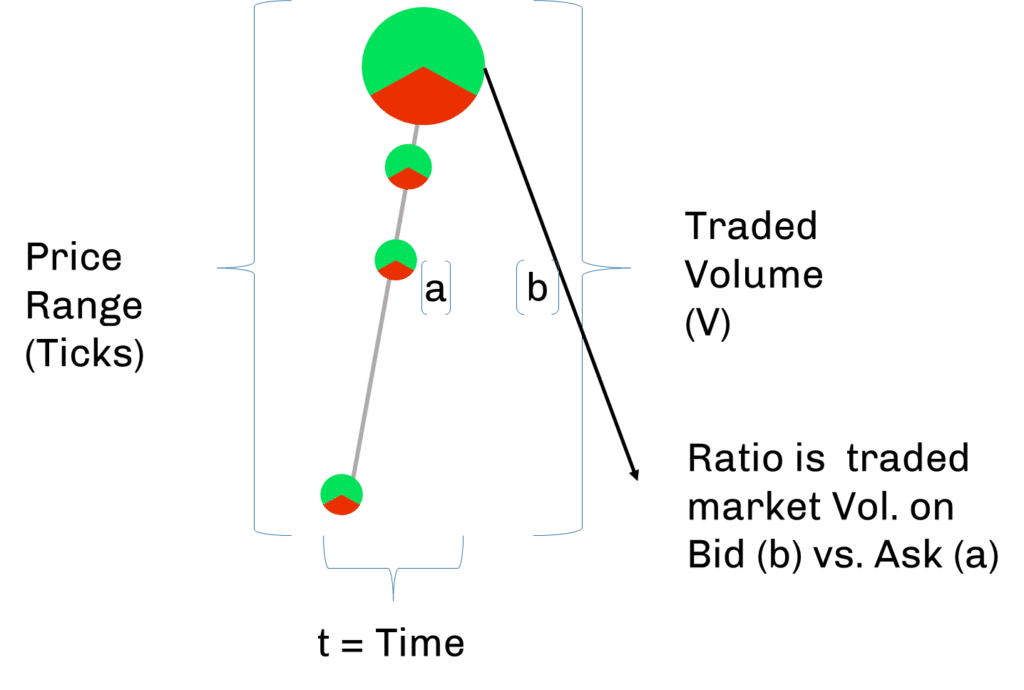

Volume spikes are defined by time (t), price in ticks (p), and the traded volume (v). Time is the main product in the formula for determining volume spikes.

TTW-TradeFinder can analyze volume spikes for all instruments (Futures, Stocks, Cryptos) based on time, price, and volume.

The ratio calculates the traded market volume against BID and ASK. The result is a ratio that defines which side has traded more contracts.

Settings #

Enable

Activates or deactivates the Volume Spike Signals.

Design and Layout

Click on the “Edit” Button to change the design, symbol, color, transparency, layout, position on the chart, and size of the signals on the chart. If you choose the design style “professional,” you will get additional information about the absorption signal.

Trigger Volume

The selected value filters the traded market volume. Volume size depends on the volume and liquidity of the respective instrument. (Refer to “Average Volume / Liquidity“).

Maximum Duration [s]

Maximum time, in seconds, for which the “Trigger Volume” must be transacted.

Price Range [ticks, cents]

A minimum number of ticks, pips, or cents that price must trade through to trigger the signal.

A ratio greater / equal

Set the ratio for market traded Bid and Ask volume. The ratio informs you instantaneously if the Volume Spike has the potential for a price continuation or price reversal.

The ratio calculates the traded market volume against BID and ASK. The result is a ratio that defines which side has traded more contracts. See the volume spike sketch above.

Alert Sound

The audio signal that sounds when a Volume Spike meets the defined conditions.

Send Telegram Notification

Enabled / Disabled allows you to notify the messenger service “Telegram”.

Important: Signal will be drawn when the Trigger Volume, Maximum Duration, and Price Range conditions are met.

Volume Spike Signals:

We have a selection of colors to choose from. The default is green for Buy Volume Spikes and red for Sell Volume Spikes.

The signals show the characteristics of the Volume Spike:

— Price Level where the Volume Spike occurred.

— P: The Volume Spike price change in ticks, pips, or cents.

— R: Rounded ratio between market Bid and Ask. These values help determine a stop run’s “integrity” or “value”.

— Volume of market bid and market ask